INDICEMENT EA: Professional Trading Algorithm for Index Markets

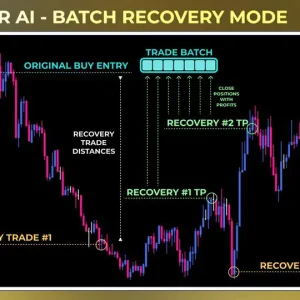

INDICEMENT EA leverages my 15 years of experience in developing professional trading algorithms, tailored specifically for the US500, US30, and NAS100 indices. This expert advisor (EA) uses a carefully designed algorithm to pinpoint optimal entry prices and employs multiple trading strategies to diversify risk. Each trade is protected by a stop loss and take profit, while also utilizing trailing stop loss and trailing take profit features to maximize trade potential and minimize risk.

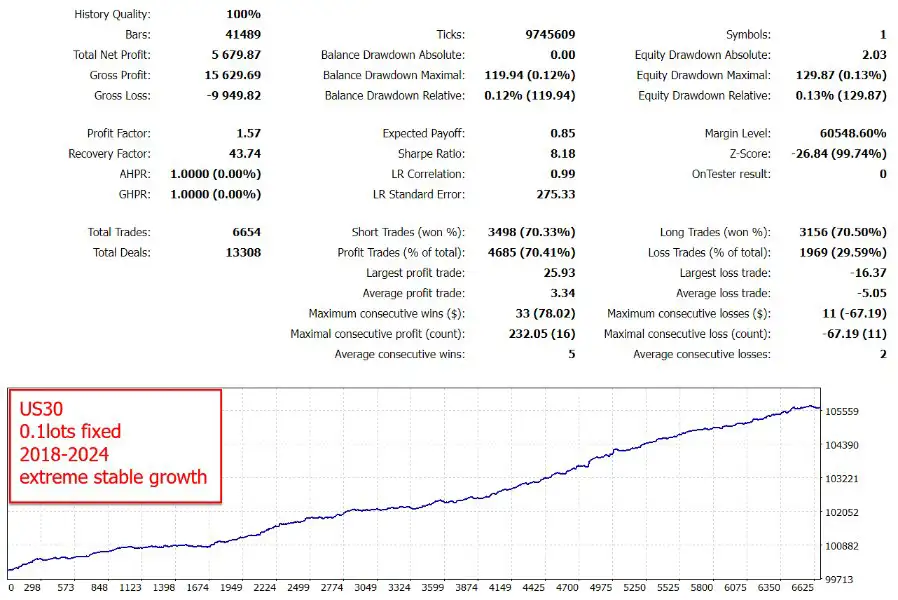

The core of INDICEMENT EA is based on a proven strategy: trading breakouts from critical support and resistance levels. After years of refining this approach, I have created a highly reliable trading system, well-suited for the volatility of the US500, US30, and NAS100 markets.

Why Choose INDICEMENT EA?

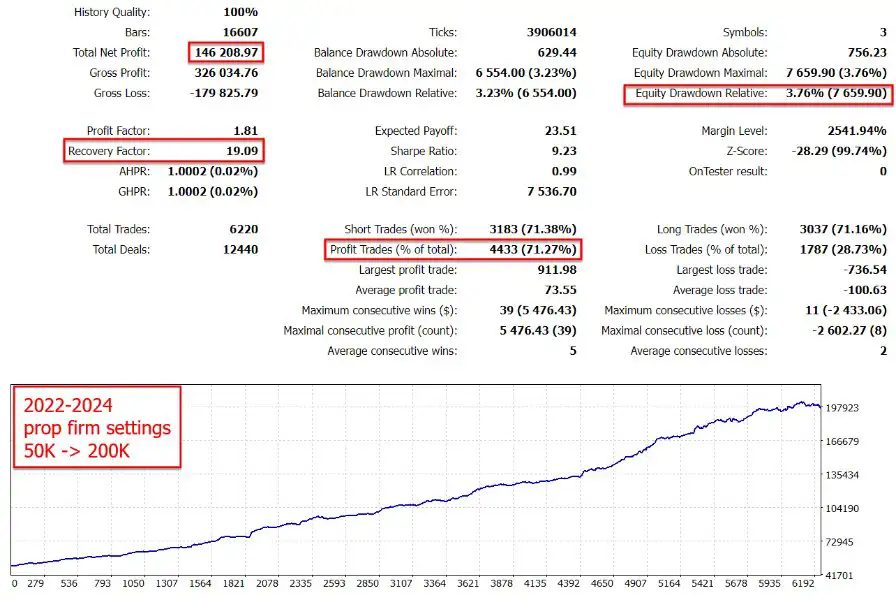

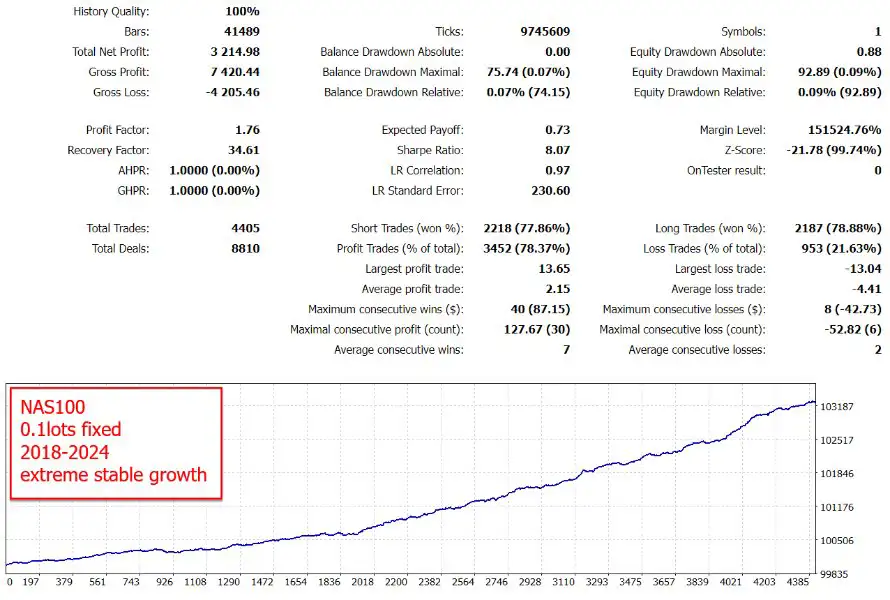

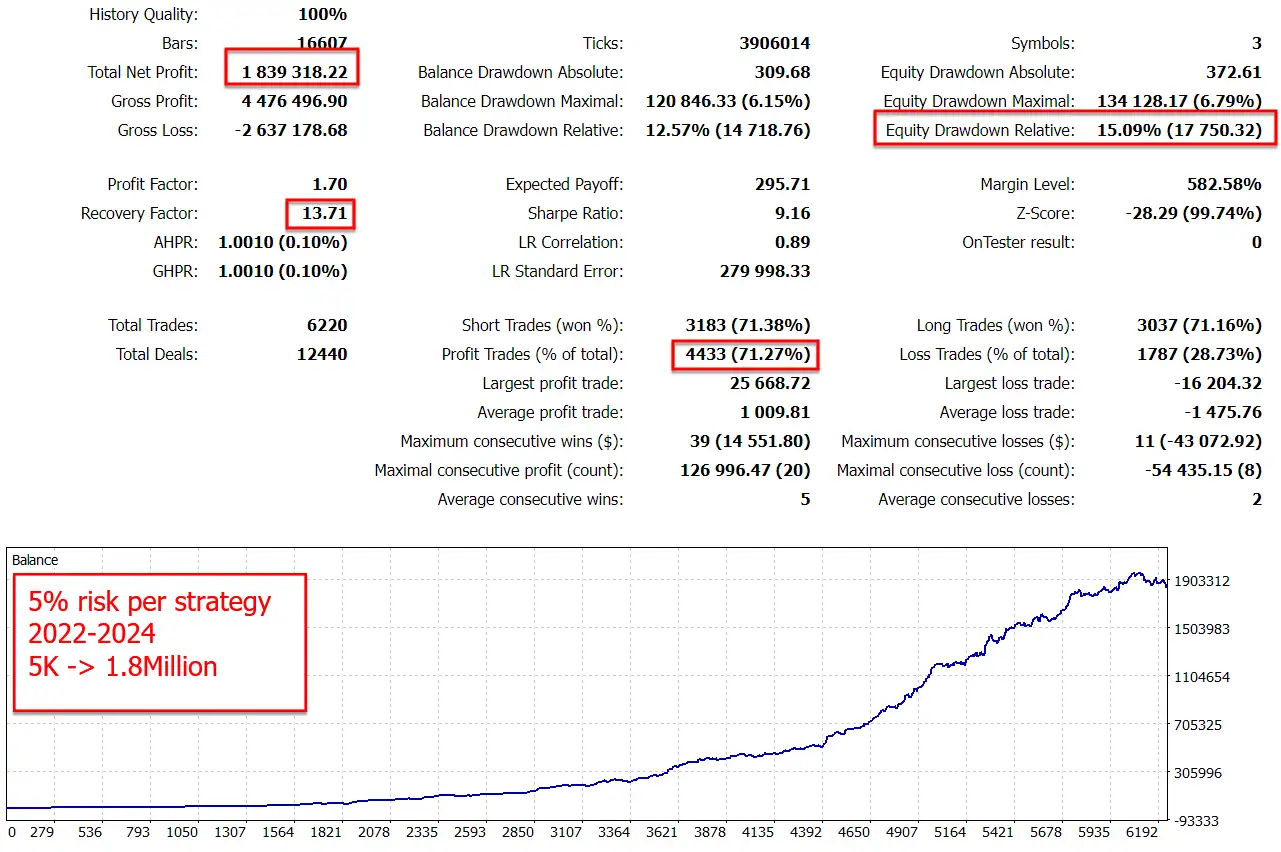

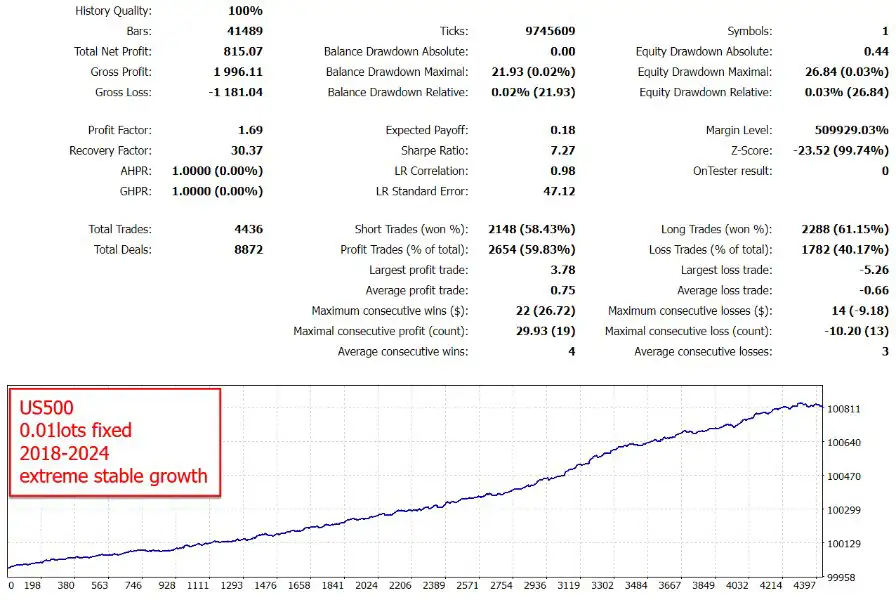

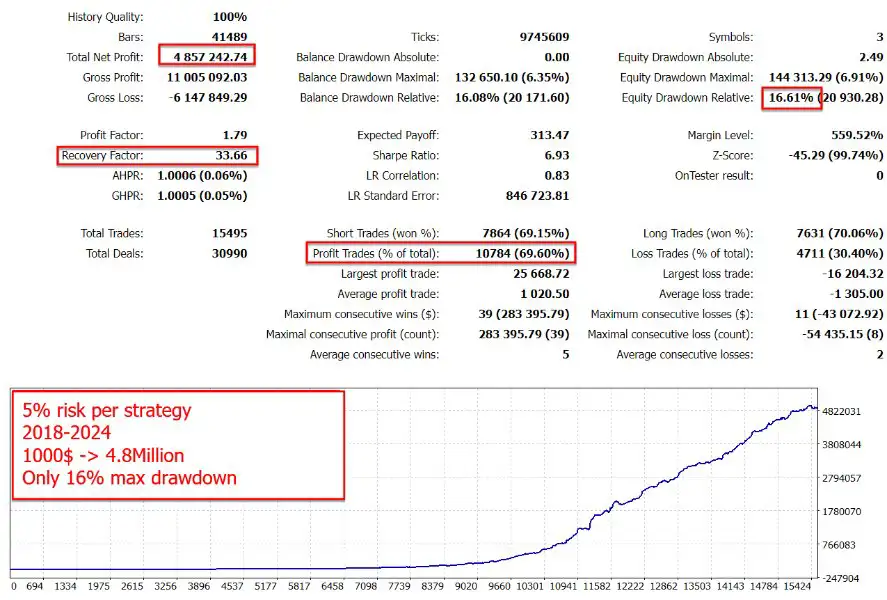

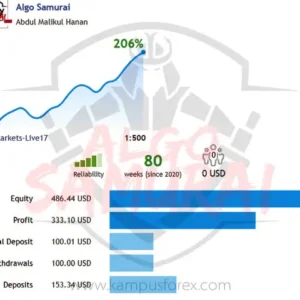

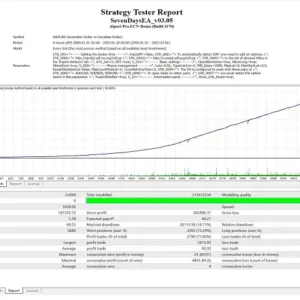

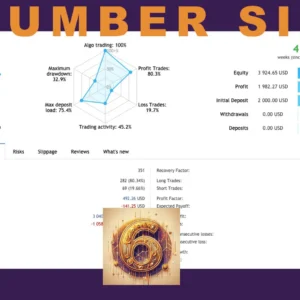

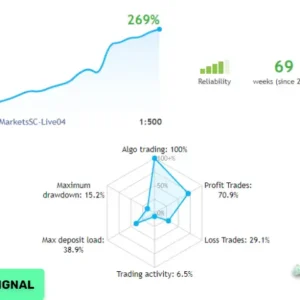

- Stable Growth: Backtests show a steady growth curve with controlled drawdowns and rapid recovery.

- Reliable Performance: Stress-tested across multiple brokers using various price feeds to prevent over-optimization.

- No Gimmicks: Unlike many EAs that claim to use “neural networks, AI, or perfect backtests,” INDICEMENT EA is a real, transparent trading system built on proven methodologies.

- Extensive Experience: Developed by a creator with over 15 years of experience in automated trading systems.

Key Features:

- Easy Setup: Install on a single H1 chart and use the provided set files.

- No Risky Methods: No grid, no martingale, and no high-risk management tactics.

- Long-term Stability: Proven stability when all strategies are employed.

- Ideal for Prop Firms: Easily integrates with prop trading firm requirements.

- Low Minimum Balance: Start trading with as little as $150 (use the “extreme low risk” set file for accounts under $300).

Setup for Backtesting:

For optimal backtesting results, use MT5 to test all indices simultaneously. If using MT4:

- Ensure correct symbol names for the three indices are entered (refer to the MarketWatch window).

- Select the symbol for backtesting in the strategy tester.

- Set the maximum drawdown per strategy or load a provided set file.

Setup for Live Trading:

- Load the EA to any H1 chart (EURUSD is recommended for the highest tick rate). The EA will automatically execute trades for all three indices.

- Ensure the correct symbol names for the three indices are configured (see MarketWatch for details).

- Set the desired maximum drawdown per strategy or use one of the available set files.

Important Configuration Tips:

AUTO_GMT Feature: To enable AUTO_GMT, add the URL “https://www.worldtimeserver.com/” to the allowed URLs in your MT4/MT5 terminal (Tools > Options > Expert Advisors).

Advanced Parameters:

- ShowInfoPanel: Display the information panel on the chart.

- Friday Stop Hour: Control whether trades are held over the weekend.

- Lot Size Calculation: Choose between fixed lot size, maximum risk per strategy, or step increment.

- Max Daily Drawdown: Set a daily drawdown limit to manage risk effectively.

INDICEMENT EA is designed for traders seeking a reliable, honest, and efficient automated trading system for the index markets. With rigorous testing and years of experience, this EA offers a high probability of replicating backtest results in live trading.

Reviews

There are no reviews yet.