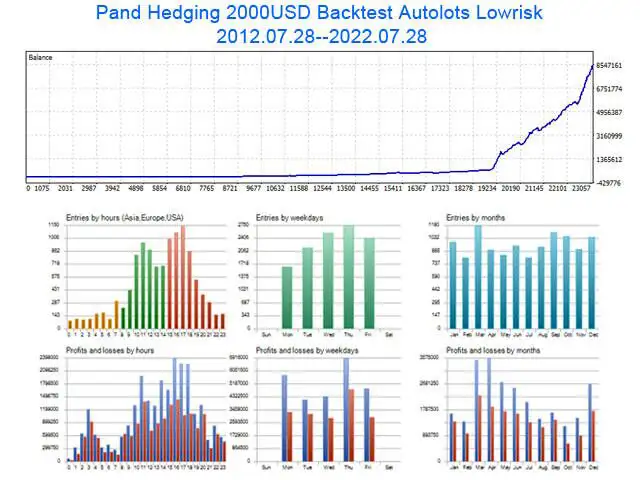

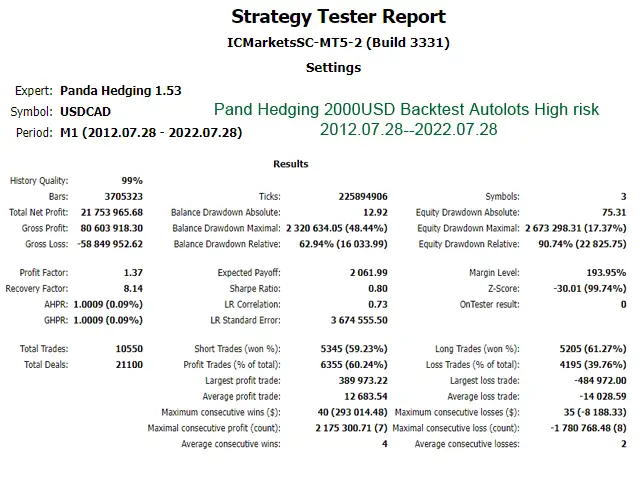

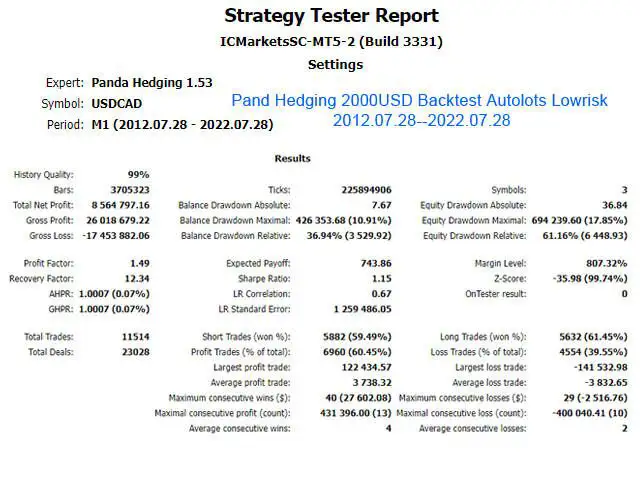

Panda Hedging MT4: A Comprehensive Forex Trading Strategy

The forex market is known for its high volatility, prompting traders to constantly develop new strategies to minimize losses and maximize profits. One of the most effective methods is hedging, which acts as a type of insurance against unfavorable market movements. However, currency deviations from their normal values can occur, requiring a more sophisticated approach.

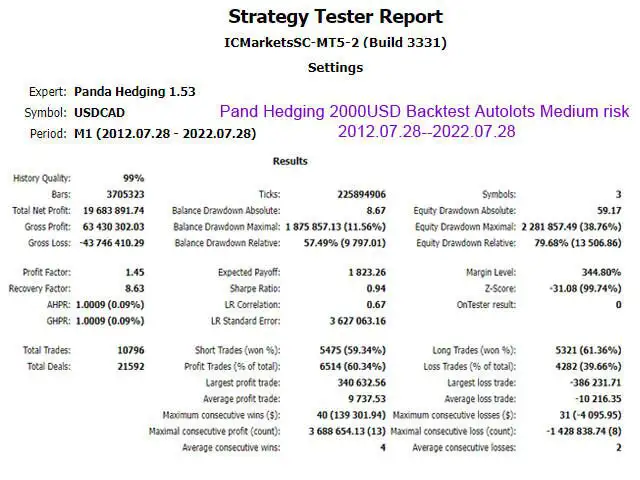

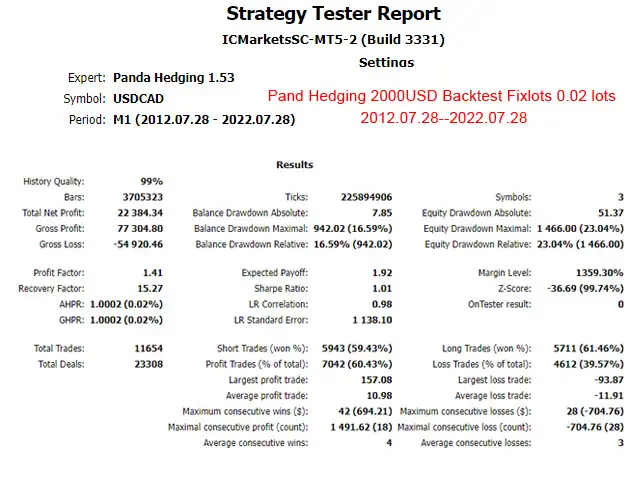

Introducing the Panda Hedging MT4 strategy, a unique automated trading system that combines the benefits of hedging with a grid trading algorithm. This system ensures high deposit protection by avoiding risky lot multiplications like Martingale. Instead, all additional orders are opened with a fixed lot size, up to a maximum of 10 orders per instrument pair.

Key Features:

- No Martingale: Fixed lot size for all additional orders, enhancing risk management.

- Automated Trading Algorithm: Opens new orders if the price moves against the initial order, according to the author’s custom algorithm.

- High Deposit Protection: Ensures a secure trading experience by minimizing the risk of large drawdowns.

Recommended Settings:

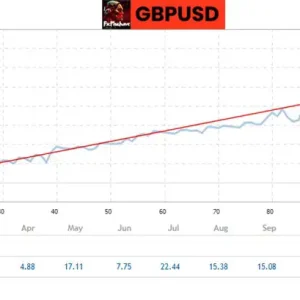

- Currency Pair & Timeframe: USDCAD on M1.

- Minimum Deposit: $1000-$1500.

- Lot Size:

- USDCAD/USDNOK: 0.02 lots.

- AUDUSD/USDNOK: 0.01 lots.

Instructions for Use:

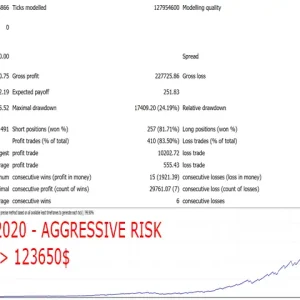

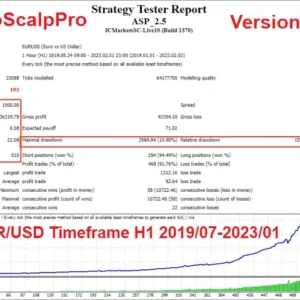

- Use the correct settings file: Panda Hedging EA 1.81 MT4 SET File.

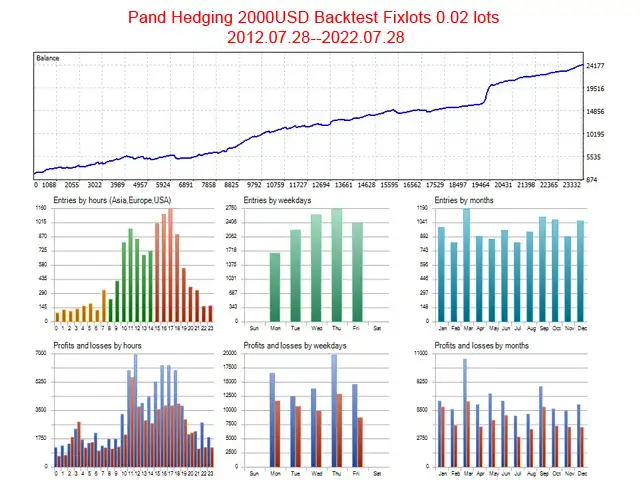

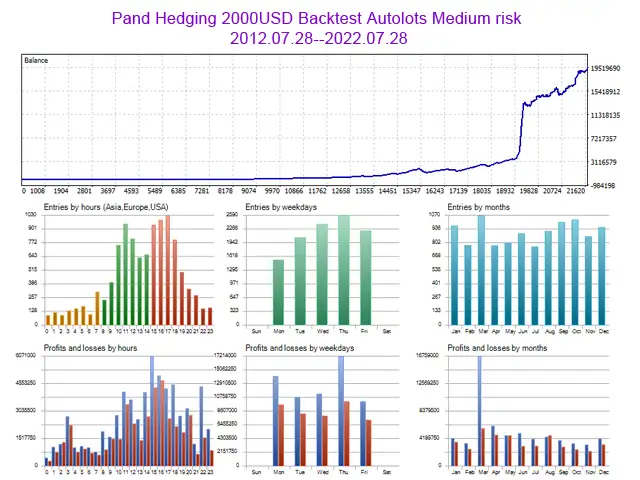

- Test the strategy with the provided Panda Hedging EA Backtest file.

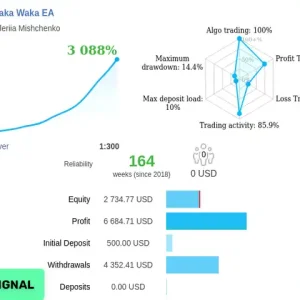

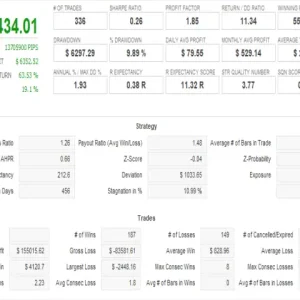

Live Performance:

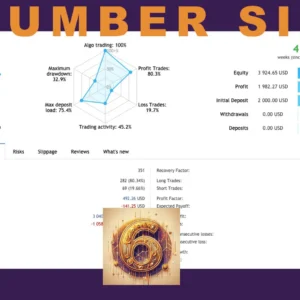

The Panda Hedging EA has been tested on a real account. Check the LIVE Signal for verified results.

Important Tips:

- Use a low spread account for optimal performance.

- Before purchasing, ensure your broker supports trading USDNOK and offers suitable leverage.

- Currently, Panda Hedging EA trades only USDCAD/USDNOK and AUDUSD/USDNOK pairs. Additional currency pairs will be included in future updates.

- Available for both MT4 and MT5 platforms.

With Panda Hedging MT4, you can take advantage of a powerful hedging strategy that minimizes risks while maximizing profit potential in volatile forex markets.

Reviews

There are no reviews yet.