Hedging Forex EA1 MT5

Smart Risk Control with ATR & Advanced Hedging Strategy

Timeframe: M5

Strategy Type: Hedging with ATR Integration

Market Focus: Volatile Forex Pairs & Gold

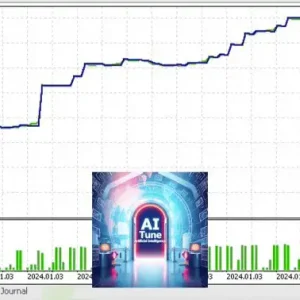

Hedging Forex EA1 MT5 is a risk-managed Expert Advisor built specifically for traders who want structured exposure control in volatile market conditions. Combining ATR-based dynamic Take Profit, intelligent lot sizing, and hedge-based trade logic, this EA delivers flexibility, capital protection, and systematic execution.

Now enhanced with virtual strategy tester guidance for improved backtesting evaluation.

Overview

Hedging Forex EA1 MT5 is engineered to manage risk intelligently while capitalizing on short-term volatility. The system integrates:

- Advanced position sizing control

- Time-filtered trade execution

- ATR-driven Take Profit logic

- Equity-based risk limitation

- Multi-trade hedging structure

Whether you are a beginner exploring hedge strategies or an experienced trader optimizing risk exposure, this EA provides the necessary tools for structured trading.

Virtual Hedge Backtesting Concept

Traditional MT4 Strategy Tester limitations prevent proper multi-symbol hedge testing. To address this, Hedging Forex EA1 introduces a conceptual workaround that simulates virtual hedging behavior during backtesting.

While not a perfect replication of live hedge conditions, this virtual logic allows traders to evaluate:

- Strategy structure

- Risk progression

- Lot multiplication logic

- Equity protection rules

This provides a practical framework before transitioning to live trading.

Core Features

Flexible Lot Management

- Manual lot sizing

- Automatic lot calculation based on equity risk percentage

- Maximum total lot exposure control

ATR-Based Dynamic Take Profit

- Adaptive TP based on market volatility

- Option to switch between dynamic ATR TP and fixed TP

- Structured profit targeting aligned with market conditions

Risk Protection System

- Equity-based loss cutoff (Loss_USD parameter)

- Maximum simultaneous trades limit

- Total lot exposure cap

- Spread filter for precision entry

- Built-in Magic Number system for trade separation

Trading Session Control

- Start and End time filters (GMT-based)

- Optional continuous trading mode

- Auto-stop after profit target (if disabled continuous mode)

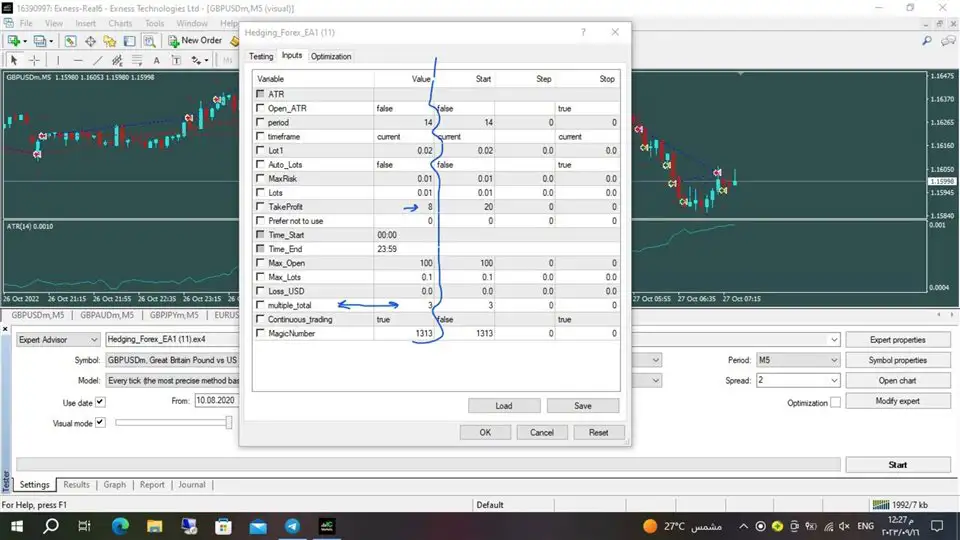

Advanced EA Parameters

The EA includes detailed customization options for strategic flexibility:

- Lot1 – Fixed lot size (when Auto_Lot = false)

- Auto_Lot – Automatic risk-based lot sizing

- Max_Risk – Percentage of equity used in auto mode

- Take_Profit – Fixed TP in points (when ATR disabled)

- Stop_Loss – Optional SL (not preferred for hedging logic)

- Open_ATR – Enables or disables dynamic ATR-based TP

- Max_Open – Maximum active trades

- Max_Lots – Total exposure limit

- Loss_USD – Equity protection threshold

- multiple_total – Controls lot progression in hedge grid

- Continuous_trading – Continue after profit or stop automatically

- Magic_Number – Unique trade identification

This level of control allows precise risk tuning based on trader profile.

Symbol Compatibility

The EA is technically compatible with all currency pairs but performs best on high-volatility major pairs such as:

- AUD/JPY

- NZD/JPY

- AUD/USD

- CAD/JPY

Gold (XAUUSD) Settings

Gold requires TP adjustment based on decimal format:

- If 2 or 3 decimal digits → Multiply TP × 10

- If 1 decimal digit → Use TP as defined

Correct configuration ensures proper TP execution accuracy.

Spread Filter Protection

Maximum Spread: 0.3 pips

This feature prevents trade execution during unfavorable spread conditions, improving entry quality and reducing hidden transaction costs.

Timeframe Optimization

Recommended Timeframe: M5 (5-Minute Chart)

The M5 timeframe provides:

- Frequent short-term entries

- Efficient hedge structure activation

- Better volatility capture

- Controlled exposure cycles

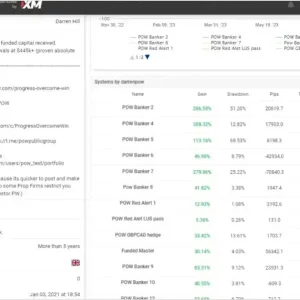

Capital & Leverage Requirements

For optimal performance:

- Minimum Recommended Capital: $5,000 (for 1 volatility pair)

- Initial Lot Size:02

- Recommended Leverage: 1:400 or higher

Proper capital allocation is essential for hedge-based progression strategies.

Why Choose Hedging Forex EA1 MT5?

- Structured hedge trading logic

- ATR-driven adaptive profit targeting

- Advanced equity protection system

- Spread filtering for cleaner entries

- Fully customizable risk parameters

- Designed for volatile forex and gold markets

- Optimized for M5 short-term trading

This is not a random grid system.

This is controlled hedging with disciplined exposure management.

Risk Disclaimer

Trading in financial markets carries significant risk and may result in partial or total capital loss.

Hedging Forex EA1 MT5 is a professional trading support tool and does not guarantee profits under any circumstances. Market conditions, broker execution, leverage, and user configuration directly impact performance.

Always apply proper risk management and never trade funds you cannot afford to lose.

Trade Volatility with Structure

If you are looking for a disciplined hedging Expert Advisor for MT5 that integrates ATR intelligence, equity protection, and structured exposure control, Hedging Forex EA1 MT5 provides a comprehensive solution.

Trade smart.

Hedge strategically.

Protect your capital.

Reviews

There are no reviews yet.